Building Cybersecurity Foundations for Financial Services: A Non-Negotiable Standard

Providing software and SaaS services to financial institutions requires a deep understanding of security, compliance, and operational resilience. Banks and financial firms operate under strict regulatory frameworks and have zero tolerance for security failures. Regulatory requirements such as APRA CPS 234 in Australia, the UK Cyber Security and Resilience Act, the EU’s Digital Operational Resilience Act (DORA), and US regulations like GLBA, FFIEC guidelines, and NYDFS Cybersecurity Regulation (23 NYCRR 500) set clear expectations for security and resilience.

Risk management is a core function in financial services, and this extends to third-party service providers. Banks must ensure their partners can meet stringent security, compliance, and resilience requirements. Companies building software for financial institutions must adopt a security-first approach, embedding protection, compliance, and operational excellence into their products and services from the outset.

Security by Design: Cloud, Development, and Compliance

Security cannot be an afterthought; it must be integrated at every stage of software development and service delivery. Cloud security best practices should be foundational, with strong data segregation, encryption, role-based access controls (RBAC), and adherence to industry frameworks like ISO 27017 (cloud security) and CSA STAR. Financial institutions expect multi-tenant security models that ensure data privacy, compliance with residency laws, and resilience against cyber threats.

Secure Software Development Lifecycle (SDLC) practices must also be embedded from the start. Financial institutions require vendors to follow secure coding principles, conduct automated security testing, and continuously monitor vulnerabilities. Secure DevOps (DevSecOps) methodologies ensure security checks occur at every stage of development rather than being bolted on later. This reduces cost, complexity, and risk while ensuring regulatory compliance.

Compliance must be continuously validated. Financial institutions demand evidence of compliance with globally recognized standards, including ISO 27001, ISO 42001, ISO 22301, and SOC 2. Real-time monitoring, independent audits, and robust change management processes ensure security remains dynamic rather than reactive.

Operational Resilience and Continuous Improvement

Financial institutions expect operational resilience to be a core function, not an afterthought. Maintaining secure and resilient services means having well-defined frameworks for asset lifecycle management, disaster recovery, and business continuity planning. SaaS providers must ensure that security controls are continuously assessed, optimized, and reinforced.

Change management is central to maintaining security and compliance. Updates, patches, and infrastructure modifications must be documented, reviewed, and tested to prevent disruptions. Continuous assurance through automated monitoring, security audits, and penetration testing is essential to staying ahead of evolving threats.

Cloud-native resilience is critical. SaaS providers should design their platforms with high availability, geographic redundancy, and failover mechanisms. Financial institutions need assurance that their critical operations can withstand cyberattacks, system failures, and other disruptions without data loss or prolonged downtime.

Regulatory Evolution and Third-Party Risk Management

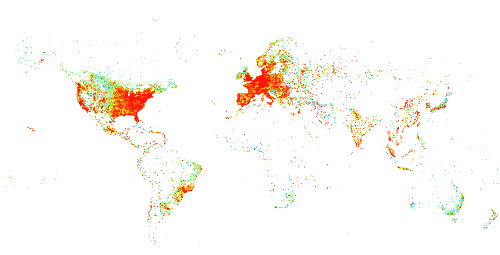

The regulatory landscape for financial institutions is continuously evolving. Between 2021 and 2024, cybersecurity regulations for financial services have increased significantly. New frameworks, such as DORA in the EU and updated NYDFS rules in the US, are tightening expectations around security, resilience, and third-party risk management. Non-compliance leads to regulatory penalties, reputational damage, and potential exclusion from financial ecosystems.

Third-party risk management is a growing concern. Financial institutions must demonstrate that their technology vendors meet security and resilience requirements. This includes thorough vendor assessments, continuous compliance monitoring, and contractual obligations ensuring third-party accountability. SaaS providers must be prepared to offer full transparency into their security practices, data protection measures, and operational resilience strategies.

Conclusion

Financial institutions need absolute confidence in their software providers. They must know where their data is stored, how it is processed, and that it is safe from cyber threats and resilient to failures. Security cannot be an afterthought - it must be integrated into development, operational processes, and regulatory compliance from day one. Cloud security best practices, secure software development, and continuous compliance validation are the foundations of trust in financial services technology.

Executive leadership must drive cybersecurity initiatives at the highest level. Cybersecurity is not simply an IT issue; it is a business-critical function that impacts trust, compliance, and operational continuity. The institutions that succeed in financial services will be those that proactively build resilience, ensure compliance, and embed security into the core of their operations.